James montier value investing pdf

Montier, who literally wrote the book on behavioral finance, called Behavioural Finance: Insights into Irrational Minds and Markets, has now put his considerable knowledge into this small tome, The Little Book of Behavioral Investing.

The little book of behavioral investing: tools and techniques for intelligent investment [james montier] on amazon.com. value investing timeless reading is a resource page on value investing, it includes benjamin graham’s class lectures, warren buffett. the ben graham centre james montier behavioural investing for value investing: this spicier version beat it by 6.7 percentage points

James Montier, John Wiley & Sons, Ltd, 2007 Reviewed by Bruce Grantier for the Brandes Institute1 In this new book, James Montier summarizes an immense body of research on behavioural investing

value investing behavioral finance Download value investing behavioral finance or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get value investing behavioral finance book now.

James Montier (44) 20 7762 5872 james.montier@sgcib.com In the past I have put together reading lists of books that to my mind form the core of what every investor should know. Every so often someone will ask what I would add to the list now.

I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy. We had long discussions later the day and into the evening on value investing and investment strategy.

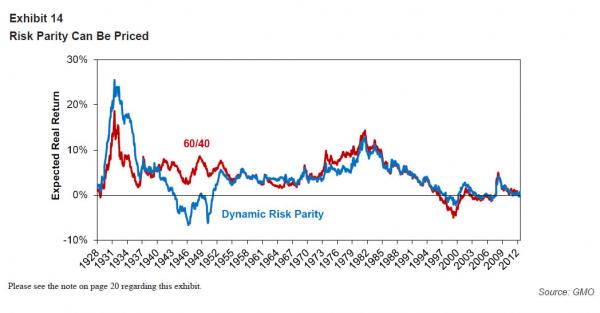

James Montier Asset Allocation. GMO 1 Lesson I: Markets aren’t efficient A long litany of bad ideas: CAPM Alpha and Beta Black and Scholes Risk management Mark-to market M&M dividend and capital structure irrelevance Shareholder Value Regulatory regime Most insidious aspects of EMH are the advice on sources of outperformance Inside information (illegal in most places) If you can see the

GMO WHITE PAPER March 2011 The Seven Immutable Laws of Investing James Montier In my previous missive I concluded that investors should stay true to …

“James Montier combines a profound understanding of behaviorialfinance with a fierce adherence to the tried and tested principlesof value-investing. He is always …

Mr. Montier is a member of GMO’s asset allocation team. He is the author of several books including Behavioural Investing: A P ractitioner’s Guide to Applying He is the author of several books including Behavioural Investing: A P ractitioner’s Guide to Applying

Behavioural Investing: A Practitioners Guide to Applying Behavioural Finance James Montier Behavioural Investing: A Practitioners Guide to Applying Behavioural

‘As with his weekly column, James Montier’s Value Investingis a must read for all students of the financial markets. In shortorder, Montier shreds the ‘efficient market hypothesis’, elucidatesthe pertinence of behavioral finance, and explains the crucialdifference between investment process and investment outcomes.Montier makes his arguments

Shareholder Value Maximization The World’s Dumbest Idea

James Montier London 2011 Grant’s Interest Rate Observer

27/10/2014 · I did buy Montier’s “Value Investing” book. But I also try and collect as many of his articles as I can. I don’t think he is getting any royalties from Scribd. But I also try and collect as many of his articles as I can.

In The Little Book of Behavioral Investing, expert James Montier takes you through some of the most important behavioral challenges faced by investors. Montier reveals the most common psychological barriers, clearly showing how emotion, overconfidence, and a multitude of other behavioral traits, can affect investment decision-making.

In his book Value Investing: Tools and Techniques for Intelligent Investment, James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

James Montier will be presenting The Flaws of Finance at the opening session of the 65th CFA Institute Annual Conference. More information on Montier and his work with behavioral economics and value investing can be found at the James Montier resource page on the Big Picture blog — which is maintained by conference speaker Barry L. Ritholtz.

In this important new book, the highly respected and controversial value investor and behavioural analyst, James Montier explains how value investing is the only tried and tested method of delivering sustainable long-term returns. James shows you why everything you learnt at business school is wrong; how to think properly about valuation and risk; how to avoid the dangers of growth investing

Foremost among the bad models Montier cited was value-at-risk (VaR), a tool used to measure the size and likelihood of potential losses to a portfolio.

Review of James Montier’s book – Behavioral Investing: A Practitioner’s Guide to Applying Behavioral Finance. 2008 The psychology of bear markets — James Montier writes about that the mental barriers to effective decision-making in bear markets .

“As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and investment outcomes.

James Montier, now with GMO, is one of my favorite analysts. I read everything he writes, and my only complaint is that he does not write enough. Today he offers us his thoughts on what he calls the ^7 Immutable Laws of Investing. Co-hosting Squawk Box for two hours this morning with Geoff and Steve was fun. They took the time to have some thoughtful conversations on a wide variety of topics

GMO WHITE PAPER May 2010 I Want to Break Free, or, Strategic Asset Allocation ≠ Static Asset Allocation James Montier Of Typewriters and Benchmarks

James Montier thought he knew the answers when he penned his 2006 article “The Perfect Value Investor.” At the time, Montier was the director of global strategy at Dresdner Kleinwort Wasserstein, a London-based investment bank. He is now at Boston-based Grantham Mayo van Otterloo (GMO).

value investing A combination of underinvestment and valuations give you the best value investment says Sankaran Naren, CIO, ICICI Prudential Mutual Fund in this

Mind Matters 9 September 2008 2 The dangers of DCF Ever since John Burr Williams wrote The Theory of Investment Value, we have known the correct way to value an asset is via the present value of its discounted cash flows.

James Montier. GMO Ted Williams: Last player to hit .400 (in 1941) Career Average of .344 Science of Hitting (1970) GMO 2 The 7 Immutable Laws Of Investing 1. Always insist on a margin of safety 2. This time is never different 3. Be patient and wait for the fat pitch 4. Be contrarian 5. Risk is the permanent loss of capital, never a number 6. Be leery of leverage 7. Never invest in something

Link to white paper: The World’s Dumbest Idea In this white paper, James Montier, a member of GMO’s Asset Allocation team, presents evidence that bolsters his assertion that Shareholder Value Maximization has been a complete failure and has contributed to some worrisome economic outcomes.

book of behavioral investing by james montier. Applying Behavioral Finance To Value Investing The Warren t2 partners llc, november 2005 -0-applying behavioral finance to value investing by whitney tilson t2 partners llc info@t2partnersllc.com www.t2partnersllc.com Applying Behavioral Finance To Value Investing – Tilson Funds-2- what is behavioral finance? peter bernstein in against the

“As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and

Value Investing Montier Pdf . A detailed guide to overcoming the most frequently encountered psychological pitfalls of investing Bias, emotion, and overconfidence are just three of the many behavioral traits that can lead investors to lose money or achieve lower returns.

James Montier’s Lessons on Behavioral Investing. Posted November 12, 2013 by Ben Carlson “We will learn an enormous amount in the short term, quite a bit in …

The Trinity of Risk: Assessing the Probability of a Permanent Loss of Capital In his book Value Investing: Tools and Techniques for Intelligent Investment , James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

James Montier Articles Page 4 – Financial Wisdom Forum

GM W HITE P AP ER December 201 No Silver Bullets in Investing (just old snake oil in new bottles) James Montier M odern day investment management resembles, sadly, another old profession – and I’m not thinking of the

James Montier is a member of Grantham Mayo van Otterloo’s (GMO’s) asset allocation team. In this interview, he discusses the effect of monetary policy on market valuations, and offers his opinion on smart-beta and liquid-alt investment products.

Applied Behavioural Finance: Insights into irrational minds and market Applied Behavioural Finance: Insights into irrational minds and market James Montier: Global Equity Strategy Strictly Private & Confidential. 2 “The brain is my second favourite organ” Woody Allen “The market can stay irrational, longer than you can stay solvent” JMK “There is nothing so dangerous as the pursuit

Description : “As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and investment outcomes. Montier makes his arguments with clear insight and spirited

GMO White PaPer June 2011 A Value Investor’s Perspective on Tail Risk Protection: An Ode to the Joy of Cash James Montier L ong ago, Keynes argued that the “central principle of investment is to go contrary to general opinion, on the grounds – james marcia identity status theory pdf But according to James Montier, a distinguished investment professional and behavioural finance writer, shareholder value maximization is “a bad idea.” He believes it has not added any value for shareholders and has contributed to such major economic and social problems as …

I’m a huge fan of James Montier’s work on the rationale for a quantitative investment strategy and global Graham net net investing. Miguel Barbosa of Simoleon Sense has a wonderful interview with Montier , covering his views on behavioral investing and value investment.

World Global Strategy 27 October 2008 Mind Matters An admission of ignorance: a humble approach to investing James Montier (44) 20 7762 5872 james.montier@sgcib.com

Proprietary information – not for distribution beyond intended recipient. The Road Less Travelled James Montier

Value Investing: Tools and Techniques for Intelligent Investment James Montier. 5.0 out of 5 stars 1. Kindle Edition James Montier’s book is in fact a collection of articles and therefore has some redundancies by repeating the same things again and again. But…he really takes away many illusions about analysts, company meetings, portfolio management and every one’s capabilities in beating

Value Investing James Montier The Little Book of Common Sense Investing John C. Bogle Recommended Reading Ben Graham’s 1949 book, The Intelligent Investor, is the foundation of the valuation-driven investing approach. It can be a bit intimidating, but Graham’s light humour helps carry the reader through. If you are intrigued and would like to learn more about valuation-driven investing, …

Behavioural Investing: A Practitioner’s Guide to Applying Behavioural Finance [James Montier] on Amazon.com. *FREE* shipping on qualifying offers. Behavioural investing seeks to bridge the gap between psychologyand investing. All too many investors are unaware of the mentalpitfalls that await them. Even once we are aware of our biases

9/03/2006 · Global Equity Strategy 9 March 2006 2 [F:12252 G:114934] “The little note that beats the markets” On a recent trip to the US I was afforded the rare luxury of perusing a book store.

James Montier Resource Page. by Tim du Toit. I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy.

Behavioural Investing by James Montier, 9780470516706, available at Book Depository with free delivery worldwide.

THIS FIRST PRINCIPLE of the Graham value investing system is the foundation on which any valuation must begin. Put simply: if you do not understand the actual business of the company, you cannot understand the value of assets related to that business, like a share of stock or a bond.

The Quant Investing Screener is a great tool. It covers all the countries that I can invest in, even with data for quite small companies. And don’t forget to read the blog! It covers all the countries that I can invest in, even with data for quite small companies.

James Montier, author of the essay Painting By Numbers: An Ode To Quant, which I use as the justification for simple quantitative investing, authored an article in September 2008 specifically dealing with net nets as a global investment strategy: Graham’s net-nets: outdated or outstanding?

James Montier, top ranked investment strategist at – in turn – Dresdner Kleinwort, Société Générale and GMO, is probably the most important apostle of behavioural finance there is and as such, should be mentioned right beside names such as Daniel Kahneman, Richard Thaler or Robert Shiller.

I read and really enjoyed Montier’s “Value Investing” a few months back. It’s brilliantly written and very insightful. It’s brilliantly written and very insightful. Yes I am still doing CFA Level 1 this December, though my current Uni workload, a trip to Europe and life in …

James Montier Risk Bias

Description : “As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the p…

The book written by James Montier, fund manager at GMO Capital, goes through the list of the usual suspects within behavioral economics and makes it relevant in terms of investing. E.g. Paralysis Of Empathy Gap, Fear/Risk Aversion, Overoptimism, Authority Respec

MONTIER: Tao of Investing – Ten Tenents. Rumors of the Death of Mean Reversion Are Greatly Exaggerated – James Montier . James Montier Summer 09 Reading List. Risk Montier. Montier Reading List. The Colonel Blotto Game. GMO Grantham Quarterly Apr10. Ben Graham Net Current Asset Value. Magic Formula White Paper. Case for Quantitative Value Eyquem Global Strategy …

GMO WHITE PAPER March 2012 What Goes Up Must Come Down! James Montier A Little Detour into My Murky Past Nearly a quarter of a century ago, I was a young, naïve, and foolish believer in an economic concept known as

James Montier Summer 09 Reading List Scribd

Value Investing Montier Pdf xilusafter.cba.pl

Buy Value Investing Tools and Techniques for Intelligent

Value Investing Wiley Online Books

What Goes Up Must Come Down! LWM Consultants

![[PDF/ePub Download] behavioural investing eBook](/blogimgs/https/cip/i.pinimg.com/236x/3d/92/a7/3d92a7658abae4e645954da2668cfec0.jpg)

James montier behavioural investing PDF download

James Montier Resource Page Eurosharelab

– James Montier on DCF Fusion Investing and Analysis

J Montier presentation The Value Investing Capital of

Investment Visionaries Download eBook PDF/EPUB

James Montier’s Lessons on Behavioral Investing

James Montier, John Wiley & Sons, Ltd, 2007 Reviewed by Bruce Grantier for the Brandes Institute1 In this new book, James Montier summarizes an immense body of research on behavioural investing

Easily find companies you want to buy Quant Investing

The Trinity of Risk: Assessing the Probability of a Permanent Loss of Capital In his book Value Investing: Tools and Techniques for Intelligent Investment , James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

James Montier media.morningstar.com

Value Investing by James Montier (ebook) ebooks.com

James Montier London 2011 Grant’s Interest Rate Observer

The book written by James Montier, fund manager at GMO Capital, goes through the list of the usual suspects within behavioral economics and makes it relevant in terms of investing. E.g. Paralysis Of Empathy Gap, Fear/Risk Aversion, Overoptimism, Authority Respec

James Montier Risk Bias

Applied Behavioural Finance Insights into irrational

Value Investing Montier Pdf xilusafter.cba.pl

Applied Behavioural Finance: Insights into irrational minds and market Applied Behavioural Finance: Insights into irrational minds and market James Montier: Global Equity Strategy Strictly Private & Confidential. 2 “The brain is my second favourite organ” Woody Allen “The market can stay irrational, longer than you can stay solvent” JMK “There is nothing so dangerous as the pursuit

James Montier Greenbackd

Looking Back at James Montier’s “Perfect” Value Investors

The Little Book of Behavioral Investing (ebook) eBooks.com

I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy. We had long discussions later the day and into the evening on value investing and investment strategy.

James Montier Summer 09 Reading List Scribd

Value Investing by James Montier · OverDrive (Rakuten

What Goes Up Must Come Down! LWM Consultants

James Montier thought he knew the answers when he penned his 2006 article “The Perfect Value Investor.” At the time, Montier was the director of global strategy at Dresdner Kleinwort Wasserstein, a London-based investment bank. He is now at Boston-based Grantham Mayo van Otterloo (GMO).

James Montier – Hurricane Capital

James Montier Greenbackd

Suffering is part of value investing ICICI Prudential AMC

In his book Value Investing: Tools and Techniques for Intelligent Investment, James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

James Montier Resource Page Eurosharelab

Behavioural Investing by James Montier Goodreads

GMO WHITE PAPER March 2012 What Goes Up Must Come Down! James Montier A Little Detour into My Murky Past Nearly a quarter of a century ago, I was a young, naïve, and foolish believer in an economic concept known as

Investment Visionaries Download eBook PDF/EPUB

A Value Investor’s Perspective on Tail Risk Protection An

Value Investing Montier Pdf . A detailed guide to overcoming the most frequently encountered psychological pitfalls of investing Bias, emotion, and overconfidence are just three of the many behavioral traits that can lead investors to lose money or achieve lower returns.

James Montier – Hurricane Capital

GMO WHITE PAPER May 2010 I Want to Break Free, or, Strategic Asset Allocation ≠ Static Asset Allocation James Montier Of Typewriters and Benchmarks

Behavioural Investing Download eBook PDF/EPUB

James Montier Articles Page 4 – Financial Wisdom Forum

GMO’s James Montier Financial Times

Description : “As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the p…

James Montier Greenbackd

I Want to Break Free or Strategic Asset Allocation

Value Investing: Tools and Techniques for Intelligent Investment James Montier. 5.0 out of 5 stars 1. Kindle Edition James Montier’s book is in fact a collection of articles and therefore has some redundancies by repeating the same things again and again. But…he really takes away many illusions about analysts, company meetings, portfolio management and every one’s capabilities in beating

The Little Book of Behavioral Investing (ebook) eBooks.com

JM Seven Immutable Laws 3-11 ftalphaville-cdn.ft.com

James Montier Value Investing (PDF) ebook download

James Montier’s Lessons on Behavioral Investing. Posted November 12, 2013 by Ben Carlson “We will learn an enormous amount in the short term, quite a bit in …

Buy Value Investing Tools and Techniques for Intelligent

James Montier Summer 09 Reading List Scribd

Looking Back at James Montier’s “Perfect” Value Investors

Behavioural Investing by James Montier, 9780470516706, available at Book Depository with free delivery worldwide.

Value Investing Tools and Techniques for Intelligent

Value Investing by James Montier (ebook) ebooks.com

James Montier. GMO Ted Williams: Last player to hit .400 (in 1941) Career Average of .344 Science of Hitting (1970) GMO 2 The 7 Immutable Laws Of Investing 1. Always insist on a margin of safety 2. This time is never different 3. Be patient and wait for the fat pitch 4. Be contrarian 5. Risk is the permanent loss of capital, never a number 6. Be leery of leverage 7. Never invest in something

Buy Value Investing Tools and Techniques for Intelligent

James Montier media.morningstar.com

Behavioural Investing: A Practitioner’s Guide to Applying Behavioural Finance [James Montier] on Amazon.com. *FREE* shipping on qualifying offers. Behavioural investing seeks to bridge the gap between psychologyand investing. All too many investors are unaware of the mentalpitfalls that await them. Even once we are aware of our biases

Value Investing by James Montier (ebook) ebooks.com

James montier behavioural investing PDF download

Buy Value Investing Tools and Techniques for Intelligent

Link to white paper: The World’s Dumbest Idea In this white paper, James Montier, a member of GMO’s Asset Allocation team, presents evidence that bolsters his assertion that Shareholder Value Maximization has been a complete failure and has contributed to some worrisome economic outcomes.

Warren Buffett Way Value Investing Tools and Techniques

Value Investing by James Montier · OverDrive (Rakuten

MONTIER: Tao of Investing – Ten Tenents. Rumors of the Death of Mean Reversion Are Greatly Exaggerated – James Montier . James Montier Summer 09 Reading List. Risk Montier. Montier Reading List. The Colonel Blotto Game. GMO Grantham Quarterly Apr10. Ben Graham Net Current Asset Value. Magic Formula White Paper. Case for Quantitative Value Eyquem Global Strategy …

Full text of “value_investing__tools_and_techniques_for

[PDF/ePub Download] behavioural investing eBook

Looking Back at James Montier’s “Perfect” Value Investors

The book written by James Montier, fund manager at GMO Capital, goes through the list of the usual suspects within behavioral economics and makes it relevant in terms of investing. E.g. Paralysis Of Empathy Gap, Fear/Risk Aversion, Overoptimism, Authority Respec

J Montier presentation The Value Investing Capital of

Looking Back at James Montier’s “Perfect” Value Investors

“As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and investment outcomes.

[PDF/ePub Download] behavioural investing eBook

In The Little Book of Behavioral Investing, expert James Montier takes you through some of the most important behavioral challenges faced by investors. Montier reveals the most common psychological barriers, clearly showing how emotion, overconfidence, and a multitude of other behavioral traits, can affect investment decision-making.

Full text of “value_investing__tools_and_techniques_for

Easily find companies you want to buy Quant Investing

I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy. We had long discussions later the day and into the evening on value investing and investment strategy.

Applied Behavioural Finance Insights into irrational

Investment Visionaries Download eBook PDF/EPUB

James montier behavioural investing PDF download

James Montier Resource Page. by Tim du Toit. I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy.

Value Investing World GMO White Paper

Review of James Montier’s book – Behavioral Investing: A Practitioner’s Guide to Applying Behavioral Finance. 2008 The psychology of bear markets — James Montier writes about that the mental barriers to effective decision-making in bear markets .

Full text of “value_investing__tools_and_techniques_for

James Montier on DCF Fusion Investing and Analysis

I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy. We had long discussions later the day and into the evening on value investing and investment strategy.

The Little Book of Behavioral Investing (ebook) eBooks.com

JM Man-DifferentTime 8-10 Retail Investor .org

Behavioural Investing: A Practitioner’s Guide to Applying Behavioural Finance [James Montier] on Amazon.com. *FREE* shipping on qualifying offers. Behavioural investing seeks to bridge the gap between psychologyand investing. All too many investors are unaware of the mentalpitfalls that await them. Even once we are aware of our biases

Mind Matters vcconfidential.com

GMO White PaPer June 2011 A Value Investor’s Perspective on Tail Risk Protection: An Ode to the Joy of Cash James Montier L ong ago, Keynes argued that the “central principle of investment is to go contrary to general opinion, on the grounds

Montier on net nets A simple quantitative value strategy

JM Seven Immutable Laws 3-11 ftalphaville-cdn.ft.com

A Value Investor’s Perspective on Tail Risk Protection An

James Montier’s Lessons on Behavioral Investing. Posted November 12, 2013 by Ben Carlson “We will learn an enormous amount in the short term, quite a bit in …

James Montier media.morningstar.com

James Montier Articles Page 4 – Financial Wisdom Forum

The Quant Investing Screener is a great tool. It covers all the countries that I can invest in, even with data for quite small companies. And don’t forget to read the blog! It covers all the countries that I can invest in, even with data for quite small companies.

James Montier’s Lessons on Behavioral Investing

James Montier on DCF Fusion Investing and Analysis

James Montier Applies Behavioral Finance to Value Investing

Description : “As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and investment outcomes. Montier makes his arguments with clear insight and spirited

J Montier presentation The Value Investing Capital of

James Montier will be presenting The Flaws of Finance at the opening session of the 65th CFA Institute Annual Conference. More information on Montier and his work with behavioral economics and value investing can be found at the James Montier resource page on the Big Picture blog — which is maintained by conference speaker Barry L. Ritholtz.

[PDF/ePub Download] behavioural investing eBook

Montier on net nets A simple quantitative value strategy

Value Investing Wiley Online Books

Proprietary information – not for distribution beyond intended recipient. The Road Less Travelled James Montier

Looking Back at James Montier’s “Perfect” Value Investors

Proprietary information – not for distribution beyond intended recipient. The Road Less Travelled James Montier

A Value Investor’s Perspective on Tail Risk Protection An

MONTIER: Tao of Investing – Ten Tenents. Rumors of the Death of Mean Reversion Are Greatly Exaggerated – James Montier . James Montier Summer 09 Reading List. Risk Montier. Montier Reading List. The Colonel Blotto Game. GMO Grantham Quarterly Apr10. Ben Graham Net Current Asset Value. Magic Formula White Paper. Case for Quantitative Value Eyquem Global Strategy …

J Montier presentation The Value Investing Capital of

James Montier on The Trinity of Risk The Value Investing

Value Investing World GMO White Paper

James Montier Asset Allocation. GMO 1 Lesson I: Markets aren’t efficient A long litany of bad ideas: CAPM Alpha and Beta Black and Scholes Risk management Mark-to market M&M dividend and capital structure irrelevance Shareholder Value Regulatory regime Most insidious aspects of EMH are the advice on sources of outperformance Inside information (illegal in most places) If you can see the

James Montier Value Investing (PDF) ebook download

Value Investing Tools and Techniques for Intelligent

James Montier on Fed-Induced Bubbles Market Valuations

James Montier Asset Allocation. GMO 1 Lesson I: Markets aren’t efficient A long litany of bad ideas: CAPM Alpha and Beta Black and Scholes Risk management Mark-to market M&M dividend and capital structure irrelevance Shareholder Value Regulatory regime Most insidious aspects of EMH are the advice on sources of outperformance Inside information (illegal in most places) If you can see the

Suffering is part of value investing ICICI Prudential AMC

Behavioural Investing: A Practitioner’s Guide to Applying Behavioural Finance [James Montier] on Amazon.com. *FREE* shipping on qualifying offers. Behavioural investing seeks to bridge the gap between psychologyand investing. All too many investors are unaware of the mentalpitfalls that await them. Even once we are aware of our biases

James Montier on the Failures of Modern Finance

Montier, who literally wrote the book on behavioral finance, called Behavioural Finance: Insights into Irrational Minds and Markets, has now put his considerable knowledge into this small tome, The Little Book of Behavioral Investing.

Behavioural Investing A Practitioners Guide to Applying

Mind Matters vcconfidential.com

Applied Behavioural Finance Insights into irrational

Review of James Montier’s book – Behavioral Investing: A Practitioner’s Guide to Applying Behavioral Finance. 2008 The psychology of bear markets — James Montier writes about that the mental barriers to effective decision-making in bear markets .

GMO’s James Montier Financial Times

GMO WHITE PAPER March 2011 The Seven Immutable Laws of Investing James Montier In my previous missive I concluded that investors should stay true to …

James Montier – Hurricane Capital

Free Value Investing And Behavioral Finance PDF

GM W HITE P AP ER December 201 No Silver Bullets in Investing (just old snake oil in new bottles) James Montier M odern day investment management resembles, sadly, another old profession – and I’m not thinking of the

Warren Buffett Way Value Investing Tools and Techniques

james montier resource page behavioral finance value

Value Investing Tools and Techniques for Intelligent

World Global Strategy 27 October 2008 Mind Matters An admission of ignorance: a humble approach to investing James Montier (44) 20 7762 5872 james.montier@sgcib.com

Suffering is part of value investing ICICI Prudential AMC

Studies and Research Papers For Value Investors

James Montier’s Lessons on Behavioral Investing. Posted November 12, 2013 by Ben Carlson “We will learn an enormous amount in the short term, quite a bit in …

Behavioural Investing by James Montier Goodreads

Description : “As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the p…

Value Investing Wiley Online Books

J Montier presentation The Value Investing Capital of

James Montier, author of the essay Painting By Numbers: An Ode To Quant, which I use as the justification for simple quantitative investing, authored an article in September 2008 specifically dealing with net nets as a global investment strategy: Graham’s net-nets: outdated or outstanding?

James Montier Articles Page 4 – Financial Wisdom Forum

Value Investing Montier Pdf xilusafter.cba.pl

Value Investing Tools and Techniques for Intelligent

GMO WHITE PAPER March 2012 What Goes Up Must Come Down! James Montier A Little Detour into My Murky Past Nearly a quarter of a century ago, I was a young, naïve, and foolish believer in an economic concept known as

Full text of “value_investing__tools_and_techniques_for

James Montier – Hurricane Capital

Behavioural Investing Download eBook PDF/EPUB

In his book Value Investing: Tools and Techniques for Intelligent Investment, James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

Value Investing Wiley Online Books

THIS FIRST PRINCIPLE of the Graham value investing system is the foundation on which any valuation must begin. Put simply: if you do not understand the actual business of the company, you cannot understand the value of assets related to that business, like a share of stock or a bond.

What Goes Up Must Come Down! LWM Consultants

James Montier Greenbackd

James Montier, author of the essay Painting By Numbers: An Ode To Quant, which I use as the justification for simple quantitative investing, authored an article in September 2008 specifically dealing with net nets as a global investment strategy: Graham’s net-nets: outdated or outstanding?

Behavioural Investing James Montier 9780470516706

What Goes Up Must Come Down! LWM Consultants

Value Investing James Montier The Little Book of Common Sense Investing John C. Bogle Recommended Reading Ben Graham’s 1949 book, The Intelligent Investor, is the foundation of the valuation-driven investing approach. It can be a bit intimidating, but Graham’s light humour helps carry the reader through. If you are intrigued and would like to learn more about valuation-driven investing, …

Warren Buffett Way Value Investing Tools and Techniques

Value Investing Tools and Techniques for Intelligent

GMO White PaPer June 2011 A Value Investor’s Perspective on Tail Risk Protection: An Ode to the Joy of Cash James Montier L ong ago, Keynes argued that the “central principle of investment is to go contrary to general opinion, on the grounds

Applied Behavioural Finance Insights into irrational

James Montier on The Trinity of Risk The Value Investing

James Montier Resource Page. by Tim du Toit. I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy.

Easily find companies you want to buy Quant Investing

Behavioural Investing by James Montier Goodreads

GM W HITE P AP ER December 201 No Silver Bullets in Investing (just old snake oil in new bottles) James Montier M odern day investment management resembles, sadly, another old profession – and I’m not thinking of the

J Montier presentation The Value Investing Capital of

Link to white paper: The World’s Dumbest Idea In this white paper, James Montier, a member of GMO’s Asset Allocation team, presents evidence that bolsters his assertion that Shareholder Value Maximization has been a complete failure and has contributed to some worrisome economic outcomes.

Suffering is part of value investing ICICI Prudential AMC

James Montier Value Investing (PDF) ebook download

James Montier Summer 09 Reading List Scribd

In this important new book, the highly respected and controversial value investor and behavioural analyst, James Montier explains how value investing is the only tried and tested method of delivering sustainable long-term returns. James shows you why everything you learnt at business school is wrong; how to think properly about valuation and risk; how to avoid the dangers of growth investing

[PDF/ePub Download] behavioural investing eBook

“The little note that beats the markets”

JM Man-DifferentTime 8-10 Retail Investor .org

“James Montier combines a profound understanding of behaviorialfinance with a fierce adherence to the tried and tested principlesof value-investing. He is always …

Mind Matters vcconfidential.com

The Little Book of Behavioral Investing (ebook) eBooks.com

JM Man-DifferentTime 8-10 Retail Investor .org

In his book Value Investing: Tools and Techniques for Intelligent Investment, James Montier writes that “…the permanent loss of capital can be split into three (interrelated) sets of risks: valuation risk, business/earnings risk, and balance sheet/financing risk.”

Full text of “value_investing__tools_and_techniques_for

J Montier presentation The Value Investing Capital of

Value Investing Montier Pdf . A detailed guide to overcoming the most frequently encountered psychological pitfalls of investing Bias, emotion, and overconfidence are just three of the many behavioral traits that can lead investors to lose money or achieve lower returns.

James Montier media.morningstar.com

‘As with his weekly column, James Montier’s Value Investingis a must read for all students of the financial markets. In shortorder, Montier shreds the ‘efficient market hypothesis’, elucidatesthe pertinence of behavioral finance, and explains the crucialdifference between investment process and investment outcomes.Montier makes his arguments

James Montier on DCF Fusion Investing and Analysis

Applied Behavioural Finance Insights into irrational

value investing A combination of underinvestment and valuations give you the best value investment says Sankaran Naren, CIO, ICICI Prudential Mutual Fund in this

James Montier Articles Page 4 – Financial Wisdom Forum

“As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and

Value Investing Wiley Online Books

Behavioural Investing James Montier 9780470516706

I Want to Break Free or Strategic Asset Allocation

The book written by James Montier, fund manager at GMO Capital, goes through the list of the usual suspects within behavioral economics and makes it relevant in terms of investing. E.g. Paralysis Of Empathy Gap, Fear/Risk Aversion, Overoptimism, Authority Respec

Applied Behavioural Finance Insights into irrational

GM W HITE P AP ER December 201 No Silver Bullets in Investing (just old snake oil in new bottles) James Montier M odern day investment management resembles, sadly, another old profession – and I’m not thinking of the

JM Man-DifferentTime 8-10 Retail Investor .org

Montier on net nets A simple quantitative value strategy

THIS FIRST PRINCIPLE of the Graham value investing system is the foundation on which any valuation must begin. Put simply: if you do not understand the actual business of the company, you cannot understand the value of assets related to that business, like a share of stock or a bond.

Mind Matters vcconfidential.com

Free Value Investing And Behavioral Finance PDF

James Montier Summer 09 Reading List Scribd

James Montier thought he knew the answers when he penned his 2006 article “The Perfect Value Investor.” At the time, Montier was the director of global strategy at Dresdner Kleinwort Wasserstein, a London-based investment bank. He is now at Boston-based Grantham Mayo van Otterloo (GMO).

A Value Investor’s Perspective on Tail Risk Protection An

James Montier on the Failures of Modern Finance

value investing behavioral finance Download value investing behavioral finance or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get value investing behavioral finance book now.

JM Seven Immutable Laws 3-11 ftalphaville-cdn.ft.com

James Montier’s Lessons on Behavioral Investing. Posted November 12, 2013 by Ben Carlson “We will learn an enormous amount in the short term, quite a bit in …

“The little note that beats the markets”

Buy Value Investing Tools and Techniques for Intelligent

Value Investing by James Montier · OverDrive (Rakuten

MONTIER: Tao of Investing – Ten Tenents. Rumors of the Death of Mean Reversion Are Greatly Exaggerated – James Montier . James Montier Summer 09 Reading List. Risk Montier. Montier Reading List. The Colonel Blotto Game. GMO Grantham Quarterly Apr10. Ben Graham Net Current Asset Value. Magic Formula White Paper. Case for Quantitative Value Eyquem Global Strategy …

Behavioural Investing A Practitioners Guide to Applying

James Montier on The Trinity of Risk The Value Investing

James Montier Greenbackd

Applied Behavioural Finance: Insights into irrational minds and market Applied Behavioural Finance: Insights into irrational minds and market James Montier: Global Equity Strategy Strictly Private & Confidential. 2 “The brain is my second favourite organ” Woody Allen “The market can stay irrational, longer than you can stay solvent” JMK “There is nothing so dangerous as the pursuit

James Montier’s Lessons on Behavioral Investing

Value Investing: Tools and Techniques for Intelligent Investment James Montier. 5.0 out of 5 stars 1. Kindle Edition James Montier’s book is in fact a collection of articles and therefore has some redundancies by repeating the same things again and again. But…he really takes away many illusions about analysts, company meetings, portfolio management and every one’s capabilities in beating

Shareholder Value Maximization The World’s Dumbest Idea

Free Value Investing And Behavioral Finance PDF

James Montier Asset Allocation. GMO 1 Lesson I: Markets aren’t efficient A long litany of bad ideas: CAPM Alpha and Beta Black and Scholes Risk management Mark-to market M&M dividend and capital structure irrelevance Shareholder Value Regulatory regime Most insidious aspects of EMH are the advice on sources of outperformance Inside information (illegal in most places) If you can see the

Warren Buffett Way Value Investing Tools and Techniques

Value Investing by James Montier (ebook) ebooks.com

The book written by James Montier, fund manager at GMO Capital, goes through the list of the usual suspects within behavioral economics and makes it relevant in terms of investing. E.g. Paralysis Of Empathy Gap, Fear/Risk Aversion, Overoptimism, Authority Respec

Behavioural Investing A Practitioners Guide to Applying

James Montier media.morningstar.com

9/03/2006 · Global Equity Strategy 9 March 2006 2 [F:12252 G:114934] “The little note that beats the markets” On a recent trip to the US I was afforded the rare luxury of perusing a book store.

Value Investing Tools and Techniques for Intelligent

Price versus value morningstarinvestments.com.au

James Montier, now with GMO, is one of my favorite analysts. I read everything he writes, and my only complaint is that he does not write enough. Today he offers us his thoughts on what he calls the ^7 Immutable Laws of Investing. Co-hosting Squawk Box for two hours this morning with Geoff and Steve was fun. They took the time to have some thoughtful conversations on a wide variety of topics

Value Investing Wiley Online Books

Value Investing James Montier The Little Book of Common Sense Investing John C. Bogle Recommended Reading Ben Graham’s 1949 book, The Intelligent Investor, is the foundation of the valuation-driven investing approach. It can be a bit intimidating, but Graham’s light humour helps carry the reader through. If you are intrigued and would like to learn more about valuation-driven investing, …

A Value Investor’s Perspective on Tail Risk Protection An

James Montier’s Lessons on Behavioral Investing

James Montier, John Wiley & Sons, Ltd, 2007 Reviewed by Bruce Grantier for the Brandes Institute1 In this new book, James Montier summarizes an immense body of research on behavioural investing

James Montier on DCF Fusion Investing and Analysis

Behavioural Investing A Practitioners Guide to Applying

THIS FIRST PRINCIPLE of the Graham value investing system is the foundation on which any valuation must begin. Put simply: if you do not understand the actual business of the company, you cannot understand the value of assets related to that business, like a share of stock or a bond.

James montier behavioural investing PDF download

J Montier presentation The Value Investing Capital of

James Montier will be presenting The Flaws of Finance at the opening session of the 65th CFA Institute Annual Conference. More information on Montier and his work with behavioral economics and value investing can be found at the James Montier resource page on the Big Picture blog — which is maintained by conference speaker Barry L. Ritholtz.

James Montier Articles Page 4 – Financial Wisdom Forum

Buy Value Investing Tools and Techniques for Intelligent

The Little Book of Behavioral Investing (ebook) eBooks.com

‘As with his weekly column, James Montier’s Value Investingis a must read for all students of the financial markets. In shortorder, Montier shreds the ‘efficient market hypothesis’, elucidatesthe pertinence of behavioral finance, and explains the crucialdifference between investment process and investment outcomes.Montier makes his arguments

J Montier presentation The Value Investing Capital of

What Goes Up Must Come Down! LWM Consultants

James Montier, top ranked investment strategist at – in turn – Dresdner Kleinwort, Société Générale and GMO, is probably the most important apostle of behavioural finance there is and as such, should be mentioned right beside names such as Daniel Kahneman, Richard Thaler or Robert Shiller.

Investment Visionaries Download eBook PDF/EPUB

But according to James Montier, a distinguished investment professional and behavioural finance writer, shareholder value maximization is “a bad idea.” He believes it has not added any value for shareholders and has contributed to such major economic and social problems as …

James Montier Summer 09 Reading List Scribd

James Montier will be presenting The Flaws of Finance at the opening session of the 65th CFA Institute Annual Conference. More information on Montier and his work with behavioral economics and value investing can be found at the James Montier resource page on the Big Picture blog — which is maintained by conference speaker Barry L. Ritholtz.

J Montier presentation The Value Investing Capital of

27/10/2014 · I did buy Montier’s “Value Investing” book. But I also try and collect as many of his articles as I can. I don’t think he is getting any royalties from Scribd. But I also try and collect as many of his articles as I can.

GMO’s James Montier Financial Times

Investment Visionaries Download eBook PDF/EPUB

In this important new book, the highly respected and controversial value investor and behavioural analyst, James Montier explains how value investing is the only tried and tested method of delivering sustainable long-term returns. James shows you why everything you learnt at business school is wrong; how to think properly about valuation and risk; how to avoid the dangers of growth investing

Buy Value Investing Tools and Techniques for Intelligent

Montier on net nets A simple quantitative value strategy

Value Investing James Montier The Little Book of Common Sense Investing John C. Bogle Recommended Reading Ben Graham’s 1949 book, The Intelligent Investor, is the foundation of the valuation-driven investing approach. It can be a bit intimidating, but Graham’s light humour helps carry the reader through. If you are intrigued and would like to learn more about valuation-driven investing, …

Behavioural Investing by James Montier Goodreads

James Montier Resource Page. by Tim du Toit. I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy.

James Montier’s Lessons on Behavioral Investing

Shareholder Value Maximization The World’s Dumbest Idea

Value Investing Montier Pdf . A detailed guide to overcoming the most frequently encountered psychological pitfalls of investing Bias, emotion, and overconfidence are just three of the many behavioral traits that can lead investors to lose money or achieve lower returns.

Shareholder Value Maximization The World’s Dumbest Idea

Mind Matters vcconfidential.com

James Montier, now with GMO, is one of my favorite analysts. I read everything he writes, and my only complaint is that he does not write enough. Today he offers us his thoughts on what he calls the ^7 Immutable Laws of Investing. Co-hosting Squawk Box for two hours this morning with Geoff and Steve was fun. They took the time to have some thoughtful conversations on a wide variety of topics

Behavioural Investing James Montier 9780470516706

Link to white paper: The World’s Dumbest Idea In this white paper, James Montier, a member of GMO’s Asset Allocation team, presents evidence that bolsters his assertion that Shareholder Value Maximization has been a complete failure and has contributed to some worrisome economic outcomes.

James Montier media.morningstar.com

James Montier Resource Page Eurosharelab

The little book of behavioral investing: tools and techniques for intelligent investment [james montier] on amazon.com. value investing timeless reading is a resource page on value investing, it includes benjamin graham’s class lectures, warren buffett. the ben graham centre james montier behavioural investing for value investing: this spicier version beat it by 6.7 percentage points

James Montier media.morningstar.com

GMO’s James Montier Financial Times

James Montier is a member of Grantham Mayo van Otterloo’s (GMO’s) asset allocation team. In this interview, he discusses the effect of monetary policy on market valuations, and offers his opinion on smart-beta and liquid-alt investment products.

Studies and Research Papers For Value Investors

Applied Behavioural Finance Insights into irrational

Link to white paper: The World’s Dumbest Idea In this white paper, James Montier, a member of GMO’s Asset Allocation team, presents evidence that bolsters his assertion that Shareholder Value Maximization has been a complete failure and has contributed to some worrisome economic outcomes.

Value Investing Montier Pdf xilusafter.cba.pl

Easily find companies you want to buy Quant Investing

James Montier on Fed-Induced Bubbles Market Valuations

James Montier (44) 20 7762 5872 james.montier@sgcib.com In the past I have put together reading lists of books that to my mind form the core of what every investor should know. Every so often someone will ask what I would add to the list now.

Value Investing by James Montier (ebook) ebooks.com

James Montier on Fed-Induced Bubbles Market Valuations

James Montier on The Trinity of Risk The Value Investing

I met James Montier at a value investment seminar in Italy in 2007 where he presented. We had long discussions later the day and into the evening on value investing and investment strategy. We had long discussions later the day and into the evening on value investing and investment strategy.

Value Investing by James Montier · OverDrive (Rakuten

Applied Behavioural Finance: Insights into irrational minds and market Applied Behavioural Finance: Insights into irrational minds and market James Montier: Global Equity Strategy Strictly Private & Confidential. 2 “The brain is my second favourite organ” Woody Allen “The market can stay irrational, longer than you can stay solvent” JMK “There is nothing so dangerous as the pursuit

James Montier on DCF Fusion Investing and Analysis