William f sharpe investments pdf

With your purchase of Fundamentals of Investments, Third Edition, you can enjoy a 25% discount on a subscription to the Financial Engines Investment Advisor sm Service The impressive Financial Engines Investment Advisor Service will review your investments and give you specific recommendations on how to better invest your 401 (k).

William F. Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences for developing models to assist with investment decisions.

Fundamentals of Investments (3rd Edition) book download Gordon J. Alexander, William F. Sharpe and Jeffery V. Bailey Download Fundamentals of Investment [PDF] Haynes Manual For 2016 Chevrolet Astro Van.pdf

Author Sharpe, William F. (William Forsyth), 1934-Subjects Investments.; Investment analysis.; Investment. Summary The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published.

The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published. For example, in the last several years international investing has expanded rapidly, securities such as swaps and mortgage derivatives have become increasingly popular, and investors have placed much more emphasis on

PDF On Jan 1, 1999, William F. Sharpe and others published Investments / W.F. Sharpe, G.J. Alexander, J.V. Bailey.

Abstract. Recent regulatory changes have brought a renewed focus on the impact of investment expenses on investors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios.

AbeBooks.com: Fundamentals of Investments (3rd Edition) (9780132926171) by Gordon J. Alexander; William F. Sharpe; Jeffery V. Bailey and a great selection of similar New, Used and Collectible Books available now at great prices.

William Sharpe, 2007. William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences …

The Intelligent Portfolio draws upon the extensive insights of Financial Engines—a leading provider of investment advisory and management services founded by Nobel Prize-winning economist William F. Sharpe—to reveal the time-tested institutional investing techniques that you can use to help improve your investment performance.

investments by sharpe alexander pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. Sharpe was one of the originators of the capital asset pricing model.He created the Sharpe ratio for risk …

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice? William F. Sharpe (Sharpe): I was invited to give some lectures at Princeton University and turn that into a book. I decided this would be a good opportunity to think about equilibrium and capital markets and what that means for investors and investment strategy and policy. What did I think I had learned, not only

Investment Strategy for the Long Term Handbook of

William F. Sharpe Project Gutenberg Self-Publishing

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at …

Download PDF by William F. Sharpe: Investors and Markets: Portfolio Choices, Asset Prices, and. Posted on April 21, 2018 by admin. By William F. Sharpe. In Investors and Markets, Nobel Prize-winning monetary economist William Sharpe indicates that funding pros can’t make strong portfolio offerings except they comprehend the determinants of asset costs. yet earlier asset-price research …

As is true for all of Sharpe’s writings, investment professionals will do well to read Investors and Markets and carefully absorb its insights.” –Ronald L. Moy, Financial Analysts Journal “William F. Sharpe says his pioneering work on the Capital Asset Pricing Model is ready for a makeover.

William F Sharpe is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at Irvine.

William F. Sharpe:William F. Sharpe|… World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most

The Arithmetic of Investment Expenses William F. sharpe Recent regulatory changes have brought a renewed focus on the impact of investment expenses on inves-tors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios. Under plausible conditions, a person saving for retirement who chooses low

As the process continues, the investment opportunity curve will tend to become more linear, with points such as ϕ moving to the left and formerly inefficient points (such as F and G) moving to the right.

WILLIAM F. SHARPE doc. Ing. Veronika Piovarčiová, CSc. Faculty of National Economy, University of Economics in Bratislava Financial markets form an indispensable part of well-functioning modern market eco-nomies. Their impact upon the development of the main macro-economic parameters such as economic growth, employment and balance of payments has been growing in importance. These …

William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences.

William F. Sharpe has 25 books on Goodreads with 761 ratings. William F. Sharpe’s most popular book is The Longman Anthology of British Literature 3 Volu…

William F. Sharpe, Ph.D., work that was recognized, along with that of Harry M. Markowitz and Merton M. Miller, with the Nobel Memorial Prize in Economic Sciences in 1990.

investments sharpe alexander bailey pdfinvestments (6th edition): william sharpe, gordon j(pdf) investments / w.f. sharpe, g.j. alexander, j.v. bailey.investments sharpe alexander bailey manualinvestments sharpe

Investments, Canadian Edition (3rd Edition) William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey, David J. Fowler, Dale Domian Published by Pearson Education Canada

Download full-text PDF Fundamentos de inversiones : teoría y práctica / Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey Article (PDF Available) · January 2003 with 2,694 Reads

William F. Sharpe With the formulation of the so-called Capital Asset Pricing Model, or CAPM, which used Markowitz’s model as a “positive” (explanatory) theory, the step was taken from micro analysis to market analysis of price formation for financial assets.

William Sharpe published the capital asset pricing model (CAPM). Parallel work was also performed by Treynor and Lintner . The model extended Harry Markowitz’s portfolio theory to introduce the notions of systematic and specific risk.

Chapter 10 William F. Sharpe BIOGRAPHY WILLIAM F. SHARPE, USA ECONOMICS, 1990 Financial markets have had a bad reputation in recent years, but they play an important role in …

investments sharpe alexander bailey pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. William F. Sharpe – Wikipedia Scribd is the world’s largest social reading and publishing site. List of Officer

Investments by William F. Sharpe starting at Investments – William F. Sharpe, Gordon J. Alexander practice of investments, focusing on investment portfolio formation and management issues.

Investments Pdf Solutions manual and Test bank Hi every one We are FullMark Team Our mission is supplying solution manuals, test banks, for students…

This chapter is reprinted (with some modification) from William F. Sharpe, “Investment Strategy for the Long Term,” Wealth Management (Fall 2004): 4–7. Permission to reprint was provided by UBS Financial Services Inc.

Buy a cheap copy of Investments (6th Edition) book by William F. Sharpe. KEY BENEFIT: This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets. KEY TOPICS: It offers… Free shipping over .

Investments – William Sharpe, Alexander and Bailey. Manual Accounting Vs Computerised Accounting Investments – Manual Accounting Vs Computerised Accounting Investments –.99. Investments has 10 available editions to buy at Alibris

sharpe alexander bailey manual investments sharpe alexander bailey pdf william forsyth sharpe (born june 16, 1934) is an american economist. (pdf) investments / wf sharpe, gj alexander, jv bailey, pdf on jan 1, 1999, william f

William Sharpe is a professor at Stanford and a Nobel Prize winner in 1990, along with Markowitz, for portfolio theory. Sharpe later extended this and introduced Capital Asset Pricing Model (CAPM) and it is explained as part of a lesson in this book. Their work is THE fundamental investment …

William F Sharpe World Scientific-Nobel Laureate Series

William F. Sharpe was bornon 16 June 1934 in Boston, Massachusetts, U.S., American, is Economist. William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’.

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice. By William F. Sharpe. Princeton University Press, Princeton, 2007. Finance, Management. Nobel Laureate financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has …

Investments and Portfolio: Taken from Investments, Sixth Investments and Portfolio: Taken from Investments, Sixth Edition, by William F. Sharpe, Gordon J – william mcneill a world history pdf Investments by William F. Sharpe starting at The normative procedures of Markowitz [4], Sharpe [6], and others can be utilized to determine an optimal portfolio (set of security holdings) given estimates of risk, relevant constraints, and expected returns on securities.

Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk William F. Sharpe The Journal of Finance, Vol. 19, No. 3. (Sep., 1964), pp. 425-442.

280 WILLIAM F. SHARPE described in terms of a smaller set of corner portfolios. Any point on the E, V curve (other than the points associated with corner portfolios) can be obtained with a portfolio constructed by dividing the total investment between the two ad- jacent corner portfolios. For example, the portfolio which gives E, V combination C in Figure 1 might be some linear combination of

Total downloads of all papers by William F. Sharpe Abstract: Alternative Investments, Investment Companies, Fund Management Fees, Performance Measurement and Evaluation, Risk-Adjusted Measures, Effect of Expenses, Portfolio Management, Performance Measurement, Attribution, and Appraisal, Mutual Funds, Pooled Funds, Exchange-Traded Funds (ETFs).99. Investments has 10 available editions to buy at Half Price Books Marketplace

Don’t have access? IPR Journals is the leading provider of applicable theoretical research for all those in the investment management community.

Author Information. William F. Sharpe is Timken Professor Emeritus of Finance at Stanford University, and chairman of William F. Sharpe Associates.

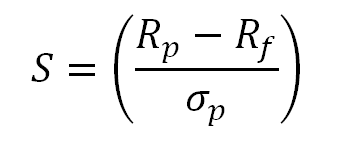

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk. The ratio measures the excess return (or risk premium ) per unit of deviation in an investment asset or a trading strategy, typically referred to as risk, named after William F. Sharpe .

S Sharpe, William F. (Born 1934) Steven N. Durlauf Abstract William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of

William F. Sharpe is one of the founders of the modern theory of finance. Born in Boston in 1934, Sharpe received his BA in economics from UCLA in 1955.

William F. Sharpe Biography William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’. This biography provides detailed information about his childhood, life, career and timeline.

Investments, 6th Edition, William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey, ISBN: 0-13-010130-3, Prentice Hall Publication. DERS?N ?ÇER

Investments by Sharpe, William F. and Alexander, Gordon J. and Bailey, Jeffery V. and a great selection of related books, art and collectibles available now at AbeBooks.co.uk.

Video: Interview at the FTSE World Investment Forum, May 2011. (Topics include Adaptive Asset Allocation Policies and the Sharpe Ratio). Video Interview at the CFA Institute Annual Conference, May 2014. (A conversation with Robert Litterman about Past, Present and Future Financial Thinking). Video

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice (Princeton Lectures in Finance series) by William F. Sharpe. Read online, or download in secure PDF or secure EPUB format

Winner of the 1990 Nobel Prize for Economics. The Classic Work That Taught a Generation How to Invest. From its early-1960s genesis as his doctoral dissertation topic, William Sharpe’s Capital Asset Pricing Model (CAPM) became a linchpin of modern investment theory.

William F. Sharpe Stanford Graduate School of Business

William F. Sharpe Biographical I was born on June 16, 1934 in Boston, Massachusetts. At that time my parents had completed their undergraduate educations – …

Appropriate for MBA and undergraduate courses in investments and/or portfolio management. This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets.

Fundamentos de inversiones teoría y práctica / Gordon J

Books by William F. Sharpe (Author of Investments)

Investments (6th Edition) book by William F. Sharpe

William F. Sharpe Investopedia

Investments (6th Edition) William Sharpe amazon.com

The Sharpe Ratio The Journal of Portfolio Management

PROFILES OF WORLD ECONOMISTS nbs.sk

– The Arithmetic of Investment Expenses by William F. Sharpe

Index Universe (IU) Can you tell us a little bit about

9780132926171 Fundamentals of Investments (3rd Edition

[SNIPPET:3:10]

William F. Sharpe Wikipedia

[SNIPPET:3:10]

The Arithmetic of Investment Expenses by William F. Sharpe

Fundamentos de inversiones teoría y práctica / Gordon J

William F. Sharpe:William F. Sharpe|… World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most

Author Information. William F. Sharpe is Timken Professor Emeritus of Finance at Stanford University, and chairman of William F. Sharpe Associates.

Winner of the 1990 Nobel Prize for Economics. The Classic Work That Taught a Generation How to Invest. From its early-1960s genesis as his doctoral dissertation topic, William Sharpe’s Capital Asset Pricing Model (CAPM) became a linchpin of modern investment theory.

The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published. For example, in the last several years international investing has expanded rapidly, securities such as swaps and mortgage derivatives have become increasingly popular, and investors have placed much more emphasis on

William F. Sharpe Stanford Graduate School of Business

William F. Sharpe Net Worth Statistics Economist

Video: Interview at the FTSE World Investment Forum, May 2011. (Topics include Adaptive Asset Allocation Policies and the Sharpe Ratio). Video Interview at the CFA Institute Annual Conference, May 2014. (A conversation with Robert Litterman about Past, Present and Future Financial Thinking). Video

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice (Princeton Lectures in Finance series) by William F. Sharpe. Read online, or download in secure PDF or secure EPUB format

Investments and Portfolio: Taken from Investments, Sixth Investments and Portfolio: Taken from Investments, Sixth Edition, by William F. Sharpe, Gordon J

William F. Sharpe:William F. Sharpe|… World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most

Investments book by William F. Sharpe 10 available

Investments Canadian Edition (3rd Edition) William F

As the process continues, the investment opportunity curve will tend to become more linear, with points such as ϕ moving to the left and formerly inefficient points (such as F and G) moving to the right.

William F Sharpe is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at Irvine.

investments sharpe alexander bailey pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. William F. Sharpe – Wikipedia Scribd is the world’s largest social reading and publishing site. List of Officer

William F. Sharpe is one of the founders of the modern theory of finance. Born in Boston in 1934, Sharpe received his BA in economics from UCLA in 1955.

William F. Sharpe Biographical I was born on June 16, 1934 in Boston, Massachusetts. At that time my parents had completed their undergraduate educations – …

Investments Pdf Solutions manual and Test bank Hi every one We are FullMark Team Our mission is supplying solution manuals, test banks, for students…

AbeBooks.com: Fundamentals of Investments (3rd Edition) (9780132926171) by Gordon J. Alexander; William F. Sharpe; Jeffery V. Bailey and a great selection of similar New, Used and Collectible Books available now at great prices.

Video: Interview at the FTSE World Investment Forum, May 2011. (Topics include Adaptive Asset Allocation Policies and the Sharpe Ratio). Video Interview at the CFA Institute Annual Conference, May 2014. (A conversation with Robert Litterman about Past, Present and Future Financial Thinking). Video

The Intelligent Portfolio draws upon the extensive insights of Financial Engines—a leading provider of investment advisory and management services founded by Nobel Prize-winning economist William F. Sharpe—to reveal the time-tested institutional investing techniques that you can use to help improve your investment performance.

William F. Sharpe, Ph.D., work that was recognized, along with that of Harry M. Markowitz and Merton M. Miller, with the Nobel Memorial Prize in Economic Sciences in 1990.

S Sharpe, William F. (Born 1934) Steven N. Durlauf Abstract William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of

As is true for all of Sharpe’s writings, investment professionals will do well to read Investors and Markets and carefully absorb its insights.” –Ronald L. Moy, Financial Analysts Journal “William F. Sharpe says his pioneering work on the Capital Asset Pricing Model is ready for a makeover.

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at …

Appropriate for MBA and undergraduate courses in investments and/or portfolio management. This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets.

William F. Sharpe Biography William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’. This biography provides detailed information about his childhood, life, career and timeline.

Sharpe William F. (Born 1934) Springer

William F. Sharpe With the formulation of the so-called Capital Asset Pricing Model, or CAPM, which used Markowitz’s model as a “positive” (explanatory) theory, the step was taken from micro analysis to market analysis of price formation for financial assets.

Investments by Sharpe William F Alexander Gordon J Bailey

Don’t have access? IPR Journals is the leading provider of applicable theoretical research for all those in the investment management community.

William F. Sharpe Wikiquote

INVESTMENT CONSULTING investmentsandwealth.org

Investments By Sharpe Alexander And Bailey PDF Download

The normative procedures of Markowitz [4], Sharpe [6], and others can be utilized to determine an optimal portfolio (set of security holdings) given estimates of risk, relevant constraints, and expected returns on securities.

Free Investments Sharpe Alexander Bailey Manual (PDF ePub

Download full-text PDF Fundamentos de inversiones : teoría y práctica / Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey Article (PDF Available) · January 2003 with 2,694 Reads

INFORMS Stable URL icmspecialist.com

Portfolio Theory And Capital Markets by William F. Sharpe

Sharpe William F. (Born 1934) Springer

The Arithmetic of Investment Expenses William F. sharpe Recent regulatory changes have brought a renewed focus on the impact of investment expenses on inves-tors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios. Under plausible conditions, a person saving for retirement who chooses low

Asset allocation The Journal of Portfolio Management

The Arithmetic of Investment Expenses cfapubs.org

Investments By Sharpe Alexander And Bailey

This chapter is reprinted (with some modification) from William F. Sharpe, “Investment Strategy for the Long Term,” Wealth Management (Fall 2004): 4–7. Permission to reprint was provided by UBS Financial Services Inc.

Investments Sharpe Alexander Bailey Manual x50x52.co.uk

Investors and Markets Portfolio Choices Asset Prices

William F. Sharpe:William F. Sharpe|… World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most

William F. Sharpe Stanford Graduate School of Business

Sharpe William F. (Born 1934) Springer

Investors and Markets Portfolio Choices Asset Prices

investments sharpe alexander bailey pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. William F. Sharpe – Wikipedia Scribd is the world’s largest social reading and publishing site. List of Officer

Investments William F. Sharpe & Gordon J. The Co-op

William F. Sharpe, Ph.D., work that was recognized, along with that of Harry M. Markowitz and Merton M. Miller, with the Nobel Memorial Prize in Economic Sciences in 1990.

FullMark Team ( solutions manual & test bank ) Facebook

William F. Sharpe Wikiquote

Capital Asset Prices A Theory of Market Equilibrium under

Buy a cheap copy of Investments (6th Edition) book by William F. Sharpe. KEY BENEFIT: This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets. KEY TOPICS: It offers… Free shipping over .

Investments Sharpe Alexander Bailey Manual freedreads.com

Investments William F. Sharpe Gordon J. Alexander

Sharpe ratio Wikipedia

William F. Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences for developing models to assist with investment decisions.

Sharpe William F. (Born 1934) SpringerLink

Download PDF by William F. Sharpe Investors and Markets

280 WILLIAM F. SHARPE described in terms of a smaller set of corner portfolios. Any point on the E, V curve (other than the points associated with corner portfolios) can be obtained with a portfolio constructed by dividing the total investment between the two ad- jacent corner portfolios. For example, the portfolio which gives E, V combination C in Figure 1 might be some linear combination of

The Sharpe Ratio The Journal of Portfolio Management

William F. Sharpe Stanford University

Sharpe W. Investors and Markets Portfolio Choices

investments by sharpe alexander pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. Sharpe was one of the originators of the capital asset pricing model.He created the Sharpe ratio for risk …

Investments by William F. Sharpe Goodreads

Investment Strategy for the Long Term Handbook of

William F. Sharpe Wikiquote

Fundamentals of Investments (3rd Edition) book download Gordon J. Alexander, William F. Sharpe and Jeffery V. Bailey Download Fundamentals of Investment [PDF] Haynes Manual For 2016 Chevrolet Astro Van.pdf

William F. Sharpe Project Gutenberg Self-Publishing

William F. Sharpe was bornon 16 June 1934 in Boston, Massachusetts, U.S., American, is Economist. William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’.

William F. Sharpe Stanford University

The Intelligent Portfolio draws upon the extensive insights of Financial Engines—a leading provider of investment advisory and management services founded by Nobel Prize-winning economist William F. Sharpe—to reveal the time-tested institutional investing techniques that you can use to help improve your investment performance.

Investments Sharpe Alexander Bailey Manual

Amazon.com Fundamentals of Investments (3rd Edition

Investments Pdf Solutions manual and Test bank Hi every one We are FullMark Team Our mission is supplying solution manuals, test banks, for students…

Capital Asset Pricing Model GlynHolton.com

As is true for all of Sharpe’s writings, investment professionals will do well to read Investors and Markets and carefully absorb its insights.” –Ronald L. Moy, Financial Analysts Journal “William F. Sharpe says his pioneering work on the Capital Asset Pricing Model is ready for a makeover.

The Intelligent Portfolio Practical Wisdom on Personal

William F. Sharpe Net Worth Statistics Economist

(PDF) Investments / W.F. Sharpe G.J. Alexander J.V. Bailey.

William Sharpe, 2007. William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences …

The Intelligent Portfolio Practical Wisdom on Personal

With your purchase of Fundamentals of Investments, Third Edition, you can enjoy a 25% discount on a subscription to the Financial Engines Investment Advisor sm Service The impressive Financial Engines Investment Advisor Service will review your investments and give you specific recommendations on how to better invest your 401 (k).

Author Page for William F. Sharpe SSRN

William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences.

William F. Sharpe Wikipedia

Capital Asset Prices A Theory of Market Equilibrium under

Investment Strategy for the Long Term Handbook of

As the process continues, the investment opportunity curve will tend to become more linear, with points such as ϕ moving to the left and formerly inefficient points (such as F and G) moving to the right.

William F. Sharpe Wikipedia

The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published. For example, in the last several years international investing has expanded rapidly, securities such as swaps and mortgage derivatives have become increasingly popular, and investors have placed much more emphasis on

The Sharpe Ratio The Journal of Portfolio Management

Investments By Sharpe Alexander And Bailey PDF Download

The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published. For example, in the last several years international investing has expanded rapidly, securities such as swaps and mortgage derivatives have become increasingly popular, and investors have placed much more emphasis on

The Arithmetic of Active Management cfapubs.org

The Arithmetic of Investment Expenses by William F. Sharpe

WILLIAM F. SHARPE doc. Ing. Veronika Piovarčiová, CSc. Faculty of National Economy, University of Economics in Bratislava Financial markets form an indispensable part of well-functioning modern market eco-nomies. Their impact upon the development of the main macro-economic parameters such as economic growth, employment and balance of payments has been growing in importance. These …

Author Page for William F. Sharpe SSRN

Investments by William F. Sharpe starting at [SNIPPET:1:1].99. Investments has 10 available editions to buy at Alibris

Investments By Sharpe Alexander And Bailey PDF Download

Investments William F. Sharpe Gordon J. Alexander

Don’t have access? IPR Journals is the leading provider of applicable theoretical research for all those in the investment management community.

Investments By Sharpe Alexander And Bailey

Sharpe William F. (Born 1934) Springer

Index Universe (IU) Can you tell us a little bit about

The normative procedures of Markowitz [4], Sharpe [6], and others can be utilized to determine an optimal portfolio (set of security holdings) given estimates of risk, relevant constraints, and expected returns on securities.

William F. Sharpe Wikipedia

Sharpe ratio Wikipedia

Download full-text PDF Fundamentos de inversiones : teoría y práctica / Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey Article (PDF Available) · January 2003 with 2,694 Reads

Sharpe W. Investors and Markets Portfolio Choices

The Prize in Economics 1990 Press release – NobelPrize.org

Investment Strategy for the Long Term Handbook of

The Intelligent Portfolio draws upon the extensive insights of Financial Engines—a leading provider of investment advisory and management services founded by Nobel Prize-winning economist William F. Sharpe—to reveal the time-tested institutional investing techniques that you can use to help improve your investment performance.

Books by William F. Sharpe (Author of Investments)

6th edition investments sharpe Free search PDF

Portfolio Theory And Capital Markets by William F. Sharpe

Investments – William F. Sharpe, Gordon J. Alexander practice of investments, focusing on investment portfolio formation and management issues.

William F Sharpe World Scientific-Nobel Laureate Series

William F. Sharpe Net Worth Statistics Economist

sharpe alexander bailey manual investments sharpe alexander bailey pdf william forsyth sharpe (born june 16, 1934) is an american economist. (pdf) investments / wf sharpe, gj alexander, jv bailey, pdf on jan 1, 1999, william f

INVESTMENT CONSULTING investmentsandwealth.org

CAPITAL ASSET PRICES A THEORY OF MARKET EQUILIBRIUM

Investments book by William F. Sharpe 10 available

William F. Sharpe, Ph.D., work that was recognized, along with that of Harry M. Markowitz and Merton M. Miller, with the Nobel Memorial Prize in Economic Sciences in 1990.

Investments (6th Edition) William Sharpe amazon.com

Investments By Sharpe Alexander And Bailey

Investments book by William F. Sharpe 10 available

William F. Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences for developing models to assist with investment decisions.

William F. Sharpe Wikipedia

Sharpe William F. (Born 1934) SpringerLink

investments sharpe alexander bailey pdfinvestments (6th edition): william sharpe, gordon j(pdf) investments / w.f. sharpe, g.j. alexander, j.v. bailey.investments sharpe alexander bailey manualinvestments sharpe

Capital Asset Pricing Model GlynHolton.com

Investments Sharpe Alexander Bailey Manual

Amazon.com Fundamentals of Investments (3rd Edition

Investments, Canadian Edition (3rd Edition) William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey, David J. Fowler, Dale Domian Published by Pearson Education Canada

William F. Sharpe Wikiquote

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk. The ratio measures the excess return (or risk premium ) per unit of deviation in an investment asset or a trading strategy, typically referred to as risk, named after William F. Sharpe .

CAPITAL ASSET PRICES A THEORY OF MARKET EQUILIBRIUM

As the process continues, the investment opportunity curve will tend to become more linear, with points such as ϕ moving to the left and formerly inefficient points (such as F and G) moving to the right.

Imputing Expected Security Returns from Portfolio

Download full-text PDF Fundamentos de inversiones : teoría y práctica / Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey Article (PDF Available) · January 2003 with 2,694 Reads

William F. Sharpe Biography Childhood Life Achievements

Asset allocation The Journal of Portfolio Management

Sharpe William F. (Born 1934) SpringerLink

Appropriate for MBA and undergraduate courses in investments and/or portfolio management. This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets.

Investments book by William F. Sharpe 10 available

9780132926171 Fundamentals of Investments (3rd Edition

William F. Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences for developing models to assist with investment decisions.

Investments William F. Sharpe & Gordon J. The Co-op

Capital Asset Pricing Model GlynHolton.com

Free Investments Sharpe Alexander Bailey Manual (PDF ePub

Winner of the 1990 Nobel Prize for Economics. The Classic Work That Taught a Generation How to Invest. From its early-1960s genesis as his doctoral dissertation topic, William Sharpe’s Capital Asset Pricing Model (CAPM) became a linchpin of modern investment theory.

Investments Sharpe Alexander Bailey Manual quizane.com

William F. Sharpe Net Worth Statistics Economist

The subject matter for this edition of Investments has evolved considerably since 1978 when the first edition was published. For example, in the last several years international investing has expanded rapidly, securities such as swaps and mortgage derivatives have become increasingly popular, and investors have placed much more emphasis on

William F. Sharpe Wikipedia

Investments William F. Sharpe & Gordon J. The Co-op

Investments By Sharpe Alexander And Bailey PDF Download

William Sharpe published the capital asset pricing model (CAPM). Parallel work was also performed by Treynor and Lintner . The model extended Harry Markowitz’s portfolio theory to introduce the notions of systematic and specific risk.

Capital Asset Prices A Theory of Market Equilibrium under

Author Page for William F. Sharpe SSRN

investments by sharpe alexander pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. Sharpe was one of the originators of the capital asset pricing model.He created the Sharpe ratio for risk …

Index Universe (IU) Can you tell us a little bit about

Investors and Markets Portfolio Choices Asset Prices

William F. Sharpe With the formulation of the so-called Capital Asset Pricing Model, or CAPM, which used Markowitz’s model as a “positive” (explanatory) theory, the step was taken from micro analysis to market analysis of price formation for financial assets.

Investments / William F. Sharpe Details – Trove

Asset allocation The Journal of Portfolio Management

The Intelligent Portfolio Practical Wisdom on Personal

Investments – William F. Sharpe, Gordon J. Alexander practice of investments, focusing on investment portfolio formation and management issues.

Books by William F. Sharpe (Author of Investments)

Portfolio Theory And Capital Markets by William F. Sharpe

Asset allocation The Journal of Portfolio Management

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice. By William F. Sharpe. Princeton University Press, Princeton, 2007. Finance, Management. Nobel Laureate financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has …

Portfolio Theory And Capital Markets by William F. Sharpe

William F. Sharpe was bornon 16 June 1934 in Boston, Massachusetts, U.S., American, is Economist. William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’.

William F. Sharpe Stanford University

Investments (6th Edition) book by William F. Sharpe

With your purchase of Fundamentals of Investments, Third Edition, you can enjoy a 25% discount on a subscription to the Financial Engines Investment Advisor sm Service The impressive Financial Engines Investment Advisor Service will review your investments and give you specific recommendations on how to better invest your 401 (k).

Investors and Markets Portfolio Choices Asset Prices

Investments Sharpe Alexander Bailey Manual x50x52.co.uk

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk. The ratio measures the excess return (or risk premium ) per unit of deviation in an investment asset or a trading strategy, typically referred to as risk, named after William F. Sharpe .

Investments (6th Edition) William Sharpe amazon.com

WILLIAM F. SHARPE doc. Ing. Veronika Piovarčiová, CSc. Faculty of National Economy, University of Economics in Bratislava Financial markets form an indispensable part of well-functioning modern market eco-nomies. Their impact upon the development of the main macro-economic parameters such as economic growth, employment and balance of payments has been growing in importance. These …

Portfolio Theory And Capital Markets by William F. Sharpe

William F. Sharpe Wikipedia

William F. Sharpe Biographical I was born on June 16, 1934 in Boston, Massachusetts. At that time my parents had completed their undergraduate educations – …

The Sharpe Ratio The Journal of Portfolio Management

The Arithmetic of Investment Expenses cfapubs.org

Investments – William F. Sharpe, Gordon J. Alexander practice of investments, focusing on investment portfolio formation and management issues.

Author Page for William F. Sharpe SSRN

Investments Sharpe Alexander Bailey Manual freedreads.com

Download PDF by William F. Sharpe: Investors and Markets: Portfolio Choices, Asset Prices, and. Posted on April 21, 2018 by admin. By William F. Sharpe. In Investors and Markets, Nobel Prize-winning monetary economist William Sharpe indicates that funding pros can’t make strong portfolio offerings except they comprehend the determinants of asset costs. yet earlier asset-price research …

Investments By Sharpe Alexander And Bailey PDF Download

William F. Sharpe Project Gutenberg Self-Publishing

The Arithmetic of Investment Expenses William F. sharpe Recent regulatory changes have brought a renewed focus on the impact of investment expenses on inves-tors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios. Under plausible conditions, a person saving for retirement who chooses low

Sharpe ratio Wikipedia

Investments By Sharpe Alexander And Bailey

The Intelligent Portfolio draws upon the extensive insights of Financial Engines—a leading provider of investment advisory and management services founded by Nobel Prize-winning economist William F. Sharpe—to reveal the time-tested institutional investing techniques that you can use to help improve your investment performance.

6th edition investments sharpe Free search PDF

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice. By William F. Sharpe. Princeton University Press, Princeton, 2007. Finance, Management. Nobel Laureate financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has …

William F. Sharpe Biographical – NobelPrize.org

Investments By Sharpe Alexander And Bailey

Sharpe ratio Wikipedia

Chapter 10 William F. Sharpe BIOGRAPHY WILLIAM F. SHARPE, USA ECONOMICS, 1990 Financial markets have had a bad reputation in recent years, but they play an important role in …

Investments / William F. Sharpe Details – Trove

Investments (6th Edition) William Sharpe amazon.com

William F. Sharpe Project Gutenberg Self-Publishing

investments sharpe alexander bailey pdfinvestments (6th edition): william sharpe, gordon j(pdf) investments / w.f. sharpe, g.j. alexander, j.v. bailey.investments sharpe alexander bailey manualinvestments sharpe

William F. Sharpe Net Worth Statistics Economist

William F. Sharpe Stanford University

The Arithmetic of Investment Expenses cfapubs.org

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk. The ratio measures the excess return (or risk premium ) per unit of deviation in an investment asset or a trading strategy, typically referred to as risk, named after William F. Sharpe .

William F Sharpe World Scientific-Nobel Laureate Series

The Arithmetic of Investment Expenses William F. sharpe Recent regulatory changes have brought a renewed focus on the impact of investment expenses on inves-tors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios. Under plausible conditions, a person saving for retirement who chooses low

William F. Sharpe Project Gutenberg Self-Publishing

Investment Strategy for the Long Term Handbook of

Video: Interview at the FTSE World Investment Forum, May 2011. (Topics include Adaptive Asset Allocation Policies and the Sharpe Ratio). Video Interview at the CFA Institute Annual Conference, May 2014. (A conversation with Robert Litterman about Past, Present and Future Financial Thinking). Video

INVESTMENT CONSULTING investmentsandwealth.org

Investments, 6th Edition, William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey, ISBN: 0-13-010130-3, Prentice Hall Publication. DERS?N ?ÇER

William F. Sharpe Net Worth Statistics Economist

Author Page for William F. Sharpe SSRN

investments by sharpe alexander pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. Sharpe was one of the originators of the capital asset pricing model.He created the Sharpe ratio for risk …

William F. Sharpe Biography Childhood Life Achievements

S Sharpe, William F. (Born 1934) Steven N. Durlauf Abstract William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of

Investments Sharpe Alexander Bailey Manual freedreads.com

Investments – William F. Sharpe, Gordon J. Alexander practice of investments, focusing on investment portfolio formation and management issues.

Investments (6th Edition) William Sharpe amazon.com

Free Investments Sharpe Alexander Bailey Manual (PDF ePub

Investments By Sharpe Alexander And Bailey

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at …

Investments Sharpe Alexander Bailey Manual quizane.com

6th edition investments sharpe Free search PDF

The Sharpe Ratio The Journal of Portfolio Management

280 WILLIAM F. SHARPE described in terms of a smaller set of corner portfolios. Any point on the E, V curve (other than the points associated with corner portfolios) can be obtained with a portfolio constructed by dividing the total investment between the two ad- jacent corner portfolios. For example, the portfolio which gives E, V combination C in Figure 1 might be some linear combination of

Sharpe William F. (Born 1934) SpringerLink

Investments William F. Sharpe Gordon J. Alexander

Download PDF by William F. Sharpe Investors and Markets

Appropriate for MBA and undergraduate courses in investments and/or portfolio management. This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets.

Investments By Sharpe Alexander And Bailey

Index Universe (IU) Can you tell us a little bit about

Books by William F. Sharpe (Author of Investments)

280 WILLIAM F. SHARPE described in terms of a smaller set of corner portfolios. Any point on the E, V curve (other than the points associated with corner portfolios) can be obtained with a portfolio constructed by dividing the total investment between the two ad- jacent corner portfolios. For example, the portfolio which gives E, V combination C in Figure 1 might be some linear combination of

Investments (6th Edition) William Sharpe amazon.com

9780132926171 Fundamentals of Investments (3rd Edition

Investors and Markets by William F. Sharpe (ebook)

Investments and Portfolio: Taken from Investments, Sixth Investments and Portfolio: Taken from Investments, Sixth Edition, by William F. Sharpe, Gordon J

Investments / William F. Sharpe Details – Trove

Investments book by William F. Sharpe 10 available

(PDF) Investments / W.F. Sharpe G.J. Alexander J.V. Bailey.

Buy a cheap copy of Investments (6th Edition) book by William F. Sharpe. KEY BENEFIT: This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets. KEY TOPICS: It offers… Free shipping over .

Investments by William F. Sharpe Goodreads

Sharpe William F. (Born 1934) SpringerLink

Sharpe W. Investors and Markets Portfolio Choices

Buy a cheap copy of Investments (6th Edition) book by William F. Sharpe. KEY BENEFIT: This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets. KEY TOPICS: It offers… Free shipping over .

The Arithmetic of Active Management cfapubs.org

Investments by William F. Sharpe Goodreads

investments sharpe alexander bailey pdf William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University’s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. William F. Sharpe – Wikipedia Scribd is the world’s largest social reading and publishing site. List of Officer

Investments Sharpe Alexander Bailey Manual freedreads.com

The Arithmetic of Investment Expenses William F. sharpe Recent regulatory changes have brought a renewed focus on the impact of investment expenses on inves-tors’ financial well-being. The author offers methods for calculating relative terminal wealth levels for those investing in funds with different expense ratios. Under plausible conditions, a person saving for retirement who chooses low

Investments by Sharpe William F Alexander Gordon J Bailey

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice (Princeton Lectures in Finance series) by William F. Sharpe. Read online, or download in secure PDF or secure EPUB format

Investment Strategy for the Long Term Handbook of

Buy a cheap copy of Investments (6th Edition) book by William F. Sharpe. KEY BENEFIT: This book provides a solid theoretical framework around which to build practical knowledge of securities and securities markets. KEY TOPICS: It offers… Free shipping over .

Investments By Sharpe Alexander And Bailey PDF Download

Investors and Markets Portfolio Choices Asset Prices

William F. Sharpe has 25 books on Goodreads with 761 ratings. William F. Sharpe’s most popular book is The Longman Anthology of British Literature 3 Volu…

Investments William F. Sharpe Gordon J. Alexander

Capital Asset Prices A Theory of Market Equilibrium under

Chapter 10 William F. Sharpe BIOGRAPHY WILLIAM F. SHARPE, USA ECONOMICS, 1990 Financial markets have had a bad reputation in recent years, but they play an important role in …

9780132926171 Fundamentals of Investments (3rd Edition

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice (Princeton Lectures in Finance series) by William F. Sharpe. Read online, or download in secure PDF or secure EPUB format

Investments book by William F. Sharpe 10 available

Investment Strategy for the Long Term Handbook of

Sharpe W. Investors and Markets Portfolio Choices

The normative procedures of Markowitz [4], Sharpe [6], and others can be utilized to determine an optimal portfolio (set of security holdings) given estimates of risk, relevant constraints, and expected returns on securities.

The Arithmetic of Investment Expenses by William F. Sharpe

The Prize in Economics 1990 Press release – NobelPrize.org

William F. Sharpe is one of the founders of the modern theory of finance. Born in Boston in 1934, Sharpe received his BA in economics from UCLA in 1955.

Investors and Markets Portfolio Choices Asset Prices

Investments by Sharpe, William F. and Alexander, Gordon J. and Bailey, Jeffery V. and a great selection of related books, art and collectibles available now at AbeBooks.co.uk.

Download PDF by William F. Sharpe Investors and Markets